How do you manage your household finances?

Until a few years ago, there’s a good chance you used Quicken, the venerable Windows and Mac finance program. Quicken was released in 1983 for MS-DOS and Apple II, at the birth of personal computing. It started to stagnate a decade ago, and never came to grips with the decline of personal computing and the inexorable shift to cloud services and mobile devices. Intuit dumped Quicken in a fire sale in 2016. The venture capital outfit that bought Quicken has been milking it for revenue, changing it to an “annual subscription” to force upgrades without actually doing anything to justify the increased cost.

Today, Quicken is an antique, used by old-timers who have decades of muscle memory. Like me! I’ve used Quicken for so many years that it’s impossible to imagine switching to something else. Quicken is slow, it’s buggy, but it’s familiar.

But what do you youngsters do?

Many of you don’t do anything. You can pull up account overviews in a browser or a phone app from your financial institutions, and that’s about as much oversight as you need.

It makes sense. There were two reasons that we began using Quicken at the dawn of time, and neither of them apply any more.

- We used Quicken to “balance our checkbook.” Think back ten or fifteen years when we wrote paper checks to pay for groceries and pay our bills and get money at the grocery store. It was difficult to find out what our account balance was from day to day. Transferring the handwritten register to Quicken shifted the burden of doing hard math, – like, say, subtraction – and gave us a snapshot of whether we had any money left. Obviously that has nothing to do with our finances today: we don’t write checks or carry checkbooks, and our balance is instantly available from any device.

- We used Quicken to check for bank errors. We’d deposit checks, they’d be entered by hand by human beings at the bank, mistakes would happen. How quaint!

Today the vast majority of our financial transactions are electronic. We don’t need to enter them manually to avoid mistakes. Instead, we need summaries and overviews and alerts, the more automated the better.

Quicken is not well suited to the modern age. It’s not very good at presenting data visually. It doesn’t run on mobile devices and it doesn’t sync with multiple devices. (Quicken has taken some baby steps to sync data online and get it to mobile devices, but they’re half-hearted and unconvincing.) Programs installed to the hard drives of computers are relics living on borrowed time.

Dozens of mobile apps and web-based services have sprung up to fill that gap. There are apps focused on checkbook management (Mint, PocketGuard), investing (Personal Capital), and budgeting (YNAB). Each has loyal followers. If you have found one that works for you, use it with my blessings. Remember, the best program for you is frequently the one that you’re familiar with.

Two more apps will appear soon. Maybe they’ll attract attention, maybe they’ll sink without a trace. Remember, only a small number of people care enough to use anything at all.

Simplifi

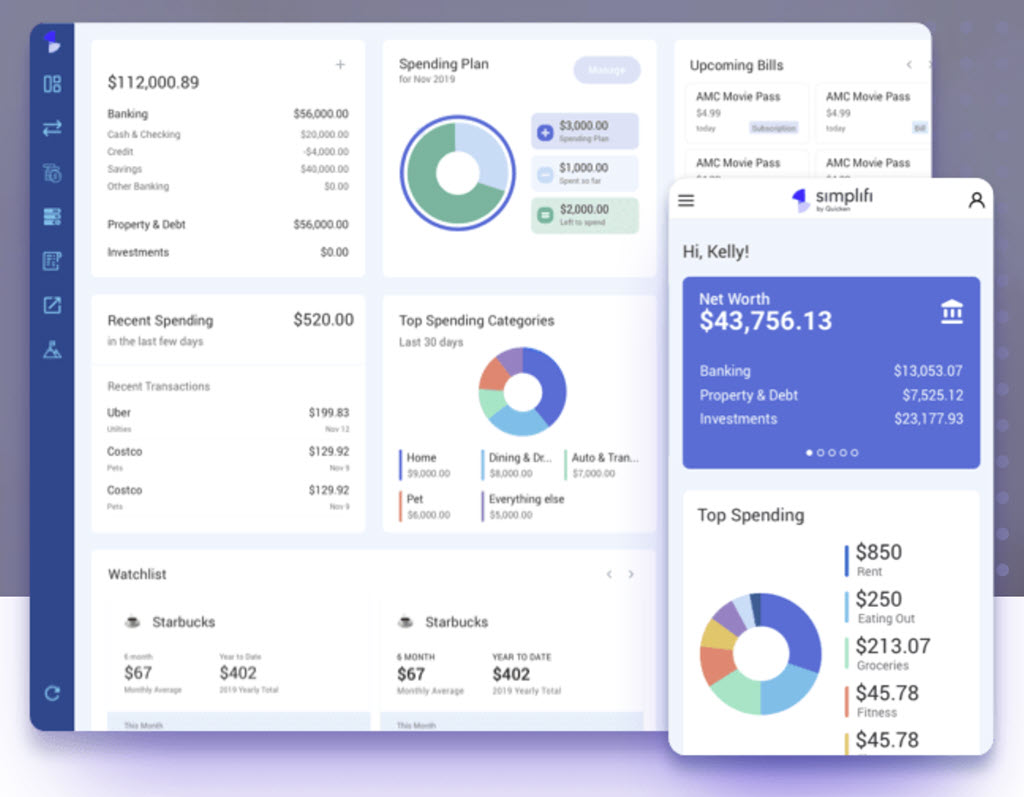

Quicken is trying to re-invent itself with Simplifi, a cloud-based app with a simple interface for viewing banking, credit card, loan, and investment information in one place. Your info can be viewed online in a web browser, or in apps for iOS and Android. It’s a subscription product, because that’s the only business plan that has a chance of working in 2020. So far it’s priced modestly, at $2.99/month or $29.99/year.

Simplifi looks modern, with lots of white space and plenty of circles and bar charts. There are a couple of positive reviews online. Perhaps they’re not promoting it yet, but at the moment it is nearly invisible – I literally only found it by accident when I was searching for something else.

I couldn’t begin to guess if Simplifi is worth your time, or whether it will be successful.

Money In Excel

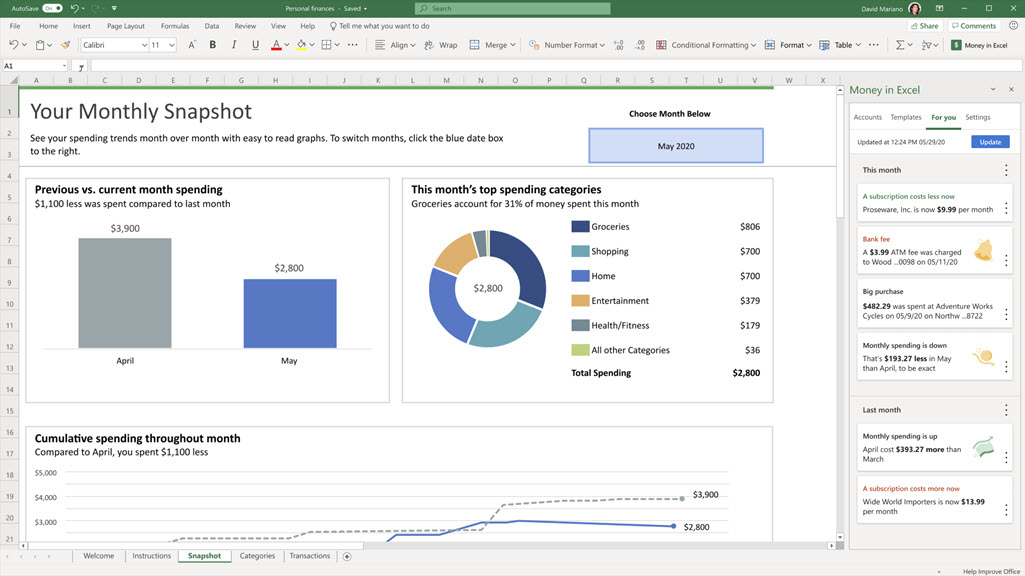

Meanwhile Microsoft is poised to release Money In Excel. It’s a fairly odd thing, even by Microsoft standards.

Money In Excel is a budget and account manager. It connects to financial institutions and downloads your transactions, then dresses up the data in bar charts and circle graphs. So far, so good. That’s more or less what the dozens of other apps and services do.

It’s not a stand-alone program, it’s not a mobile app, it’s not a web-based service. Instead, Money In Excel is a plug-in for Excel, a supersized template that creates a very complex spreadsheet. You link to your accounts and the spreadsheet downloads transactions, then dresses them up with personalized charts and graphs.

That’s a bit old school, eh? I haven’t used it so I’m left with some questions. Does Money In Excel create a single big XLSX file? Can you access it offline? Is it required to be stored in OneDrive? There has to be something syncing under the hood, because Microsoft makes it clear in the Money In Excel FAQ that your financial data is held online not just by Microsoft, but also by Plaid, the independent third party that handles the connections to the financial institutions. From the FAQ:

“WHERE IS THE DATA STORED?

“Data is stored in the United States using Microsoft’s Azure cloud services. Plaid also maintains financial data.”

The other odd thing about Money In Excel is that it is only accessible in the US, and only to subscribers to one of Microsoft’s consumer licenses, currently named Microsoft 365 Personal and Microsoft 365 Family. Let’s unpack that – it’s a bit strange.

- The primary reason to buy Microsoft 365 Personal or Family is to be able to run the Office programs – Word, Excel, Powerpoint.

- You also get lots of OneDrive space with those subscriptions, a nice but fairly trivial bonus. Really, the Office programs are the reason anyone subscribes.

- But you might be running the Office programs at home using a license purchased by your business. Office 365 business licenses are expressly set up so employees can also use the licenses on their home computers. Each Office 365 business license for the Office programs can be used on up to five computers.

- If you use your business license to install Word and Excel at home, you have no reason to buy Microsoft 365 Personal or Family.

- In which case you can’t use Money In Excel. Which makes no sense. Employees have budgets and expenses. Why isn’t this also available for business Office 365 subscribers?

And one more thing.

- If you know where your Office license comes from on your home PC – or for that matter, if you know whether or not you have a consumer Microsoft 365 subscription – you are smarter than the average bear. Because I deal with normal non-tech people every day, and I know you guys don’t have any idea about that stuff. It’s not your fault. It’s Microsoft’s fault for creating impenetrable, constantly changing mazes of accounts and subscriptions and licenses that are guaranteed to cause confusion.

If you’re curious, you can try Money In Excel. Unless you can’t. You can download it from this page. There’s a download link at the top. Now, granted, when I click on the Download link, the circle swirls for a minute and then nothing happens, but maybe it knows I don’t have the right subscription, or maybe I’m blacklisted for being snarky. Anyway, spin the Microsoft roulette wheel, maybe you’ll be able to run it.

And it might work for you, unless it doesn’t, because it looks a bit lightweight, to be honest.

Oh, Microsoft.

Thank you for the article.

It was about 1995 when I started managing my Household Finances. I generated my own programme using Lotus 123 that later moved to Excel. I have stayed there ever since. Did I ever think of Quicken? Yes. BUT, I never found a programme that dealt with:

Regular payments every 4 weeks that meant in some months you got two payments.

The “Tax Year” (5 April) problem when interest on some Savings accounts is accrued every 31 Dec.

Commitment. My Credit Card accounting period is 9th of each Month and the Repay date is 20 days later. So if I buy an Item on my Credit card on the 8th of the Month, it has to be repaid on the 28th of the same Month BUT if I buy an Item on my Credit card on the 9th of the Month, it doesn’t have to be repaid till the on the 28th of the following Month.

The list goes on and changes happen and the Spreadsheet evolves, after all, this is real-life.

Would I change? No because it costs me nothing, it has lots of error checking built and is reliable (it has been running for 25 years!). Has it ever crashed? No. Does it access my accounts automatically? No, I decide when I connect to my accounts. Can I access data from years ago? Yes. Can it see the trends to budget for the future? Yes.

Call me old-fashioned? Yes and pleased to be 75.